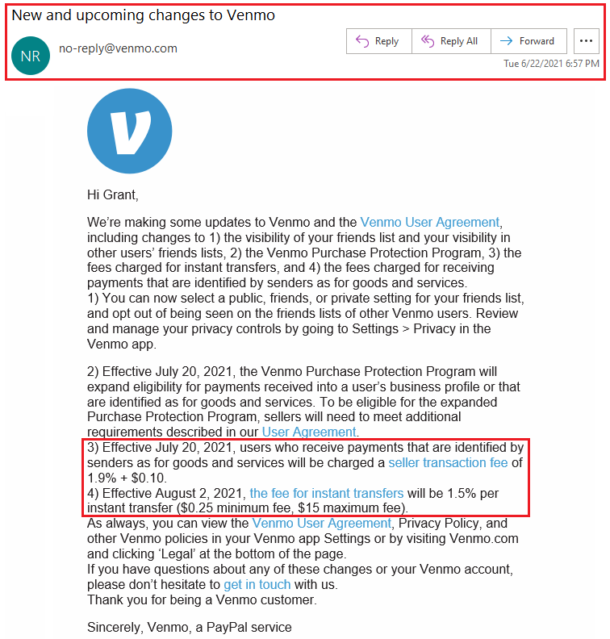

Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Products not available in all states.īank deposit accounts, such as checking and savings, may be subject to approval. JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. Insurance products are made available through Chase Insurance Agency, Inc. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Past performance is not a guarantee of future results. Once you do, you can transfer up to 19,999.99 per week to your bank. You can raise this limit by confirming your identity (see instructions below). before you transfer money, especially when you use apps like Venmo. Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved. If your identity has not been confirmed yet, the limit on the funds that you can send to your bank account is 999.99 per week (depending on security checks at Venmo). Looking at speed, cost and transfer limits can help you choose the right method for. "Chase Private Client" is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking℠ account. is a wholly-owned subsidiary of JPMorgan Chase & Co. Venmo retains sole discretion to apply and change limits.“Chase,” “JPMorgan,” “JPMorgan Chase,” the JPMorgan Chase logo and the Octagon Symbol are trademarks of JPMorgan Chase Bank, N.A. Limits are subject to periodic review and may be changed based on your Venmo Account history, activity, and other factors, including but not limited to your Venmo Mastercard Debit Card activity. For example, if you initiate a standard bank transfer on a Monday at 11:00 AM, that transfer will no longer count against your limit at 11:01 AM the following Monday. This means that a transaction counts against a limit for precisely one week from the time of authorization. Most transaction limits on your account are rolling weekly limits. You'll need to initiate multiple transfers if you want to transfer more than 5,000. It’s important to remember that these types of transfers can be declined for reasons other than the limits. If you’ve confirmed your identity, you can transfer up to 19,999.99 to your bank per week. Adding money from a debit card has a separate limit of $2,000 per week.You may be able to add up to $10,000 per week using your bank to add money You can raise this limit by confirming your identity (see instructions at the url below).

Some Venmo users can add money to their Venmo account, though this isn’t required to make payments on Venmo. Transfers can be declined for reasons other than the limit. If you are using instant transfer, you’ll need to transfer at least $0.26 – you can’t transfer less than $0.25 using instant transfer.You'll need to initiate multiple transfers if you want to transfer more than $5,000. If you’ve confirmed your identity, you can transfer up to $19,999.99 to your bank per week.If you have not yet completed identity verification, you can send up to $999.99 to your bank per week (depending on security checks at Venmo).There are a few limits for moving money from Venmo to your bank account: Learn about limits for moving money in and out of your personal Venmo account.

0 kommentar(er)

0 kommentar(er)